Protests in Peru have been ongoing since the December 2022 arrest of former president Pedro Castillo. As the country enters its fourth month of unrest, Jervin Naidoo explores the impact on Peru’s mining sector and the knock-on effect for global copper prices.

On 7 December 2022, President Pedro Castillo announced plans to dissolve Peru’s Congress and appoint an emergency government that would rule by decree. The move prompted mass resignations across his cabinet and set in motion a series of reprisal actions that would result in Castillo’s arrest on charges of conspiracy and rebellion. The arrest served as the final weight against his administration and paved the way for the third and final effort to impeach the left-wing leader. Although he has since been replaced by his deputy, Dina Boluarte Zegarra, Castillo had long faced accusations of corruption and criticism over his leftist leanings. And, with his Free Peru party holding only 37 out of the 130 total seats in Congress, he held little sway in stifling his opponents. However, though his adversaries have been successful in removing Castillo from office, his dismissal has been met with a surge in protests by his supporters. First concentrated on the streets of Lima, unrest has since spread to many parts of the country, and with little sign of petering out, these protests could present a new threat to Peru’s prospects in the global copper market.

A people’s president

Castillo remains extremely popular among the rural Peruvian population, especially in the south of the country. During the first round of the 2021 elections, for example, he won just 18 percent of the national vote but received more than 62 percent of the vote in the southern Aprurimac, Ayacucho, Puno, and Hiancavelicia departments. Much of his success at the ballot box in these parts has been attributed to Castillo’s strong leftist campaign, in which he advocated for the redistribution of mining profits, as well as his position on indigenous rights, promising greater inclusion and equality for indigenous communities in Peru. While these southern regions host large indigenous communities and are predominately rural, they are also home to Peru’s largest copper and gold deposits, bringing Peru’s mining operations into the crosshairs of the impact of the unrest.

Campaigns, copper and confidence

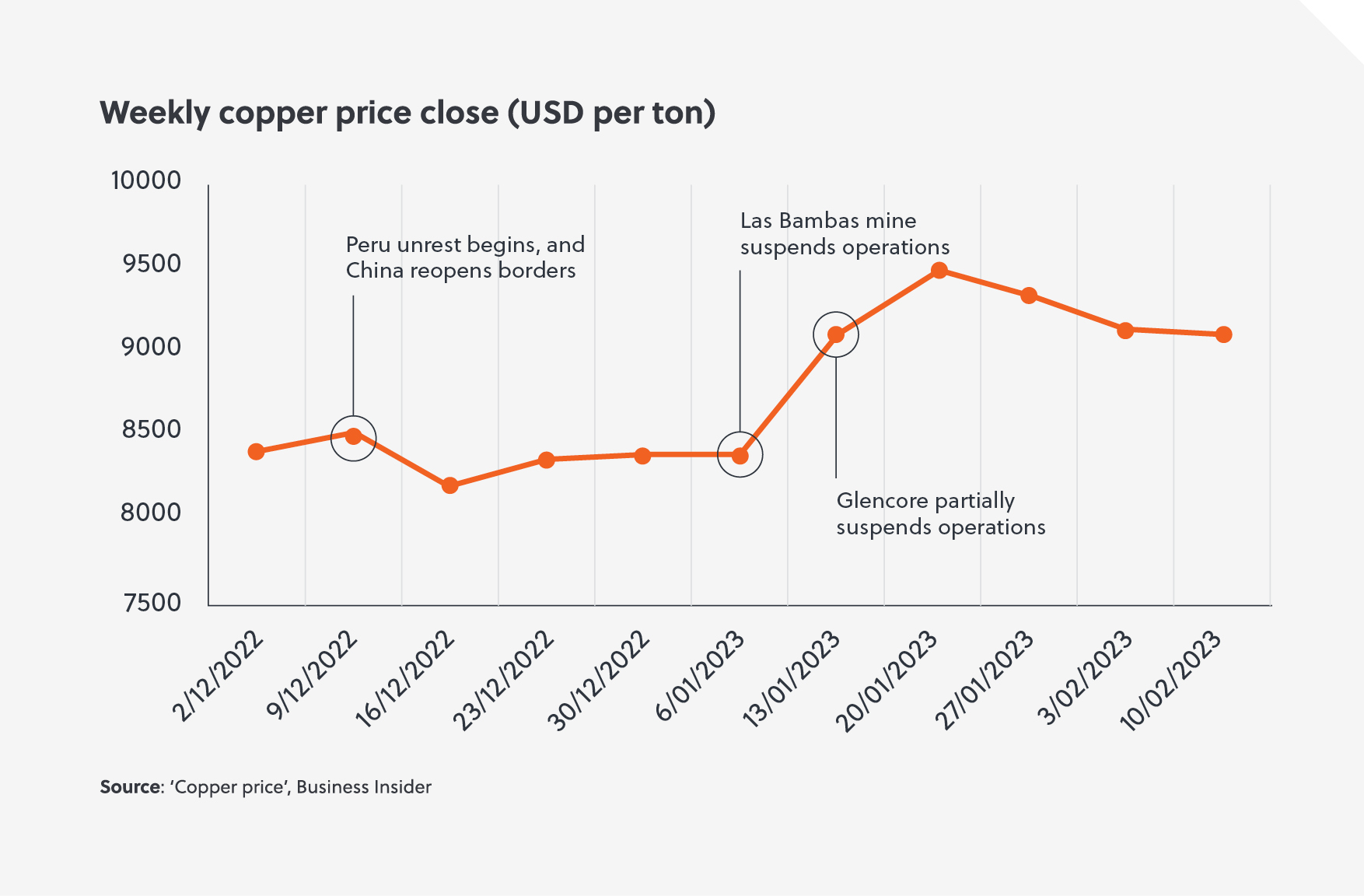

Although protest action targeting mining operations is not uncommon in Peru, the latest unrest has continued with an intensity that has sought to undermine copper producers’ confidence in the country. Protesters have blockaded roads, vandalised mining equipment, stopped trucks from transporting copper, and hindered the supply of materials used in copper mining. The unrest has led to the disruption of at least 40 percent of Peru’s total copper production, and, according to the Peruvian mining authorities' estimates, USD 160 million of copper production has been lost since the civil unrest began. The Las Bambas mine, run by a Chinese state-owned enterprise (SOE), China Minmetals Corporation (CMC) and which is responsible for two percent of global copper production, has suspended operations indefinitely.

The unrest has led to the disruption of at least 40 percent of Peru’s total copper production, and, according to the Peruvian mining authorities' estimates, USD 160 million of copper production has been lost since the civil unrest began."

Mines in the north of the country have sought to pick up the slack in recent weeks, increasing output by 30 percent and helping to stabilise copper prices at the USD 9,500 per ton. However, the Antamina Mine in Ancash, owned by Glencore, and Toromocho Mine, owned by Aluminium Corporation of China (ACC), have both expressed concern that they may not be able to maintain these extremely high production levels for long. Historically, the Peruvian mining sector has always compensated for losses linked to production disruptions with around two to four percent factored into yearly losses. The current estimate for 2023 is already at three percent , which if surpassed, will impact Peru’s mining prospects.

Supply and demand

The impact on Peru’s copper production comes at a time when global demand for copper is on the rise. China’s December 2022 decision to end its "zero Covid-19" policy and the reopening of its borders, coupled with the International Organisation of Motor Vehicle Manufacturers (OICA) forecasting that the copper-intense electric vehicle (EV) market is set to grow by at least 30 percent in 2023, will mean growing copper demand globally. Major copper producers such as Chile, China, Australia and Zambia are likely to step into the breach, but the slowdown of the world’s second largest producer of copper will still be felt. What’s more, if Peru is unable to quell the unrest and appease copper producers’ concerns, it could lose out on the key economic opportunities driven by the mining sector and high global commodity prices. Already, Anglo American, CMC, and Glencore, which are responsible for running 60 percent of Peru's mines, have indicated that they may indefinitely suspend operations in Peru to focus on copper mines in other countries.

Ship up to ship out

Peru will need to address not only the recent unrest but the underlying drivers of political instability in the country if it is to shore up renewed confidence as a major copper player. Yet, with Boluarte’s already limited popular support waning and the population’s calls for early elections in 2024 growing, there could be more instability on the horizon for Peru in the coming year.